比特币分叉币bgh

Understanding Bitcoin Forks

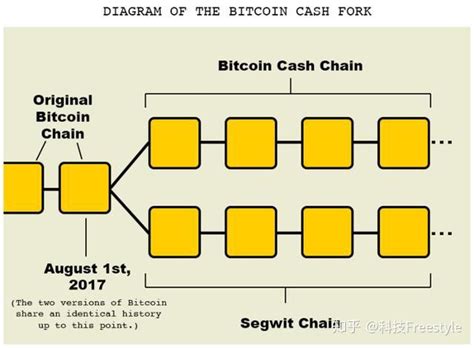

A Bitcoin fork is a fundamental change in the protocol of the Bitcoin network that results in two separate versions of the blockchain with a shared history up to a certain point. There are two main types of forks in the context of Bitcoin: hard forks and soft forks.

A hard fork occurs when a change is made to the Bitcoin protocol that is not backward compatible. This means that nodes running the old version of the software will not be able to validate blocks created by nodes running the new version. As a result, the network splits into two separate chains. Each chain will have its own set of rules and may be supported by different groups of miners and developers.

Hard forks can be contentious and lead to disagreements within the community. Examples of hard forks in Bitcoin's history include the creation of Bitcoin Cash (BCH) in 2017 and Bitcoin SV (BSV) in the same year.

A soft fork, on the other hand, is a backward-compatible change to the Bitcoin protocol. This means that nodes running the new software can still validate blocks created by nodes running the old software. Soft forks are typically less disruptive than hard forks and do not result in a split of the network. However, they can still lead to temporary disruptions as the network transitions to the new rules.

When a fork occurs, holders of Bitcoin on the original chain will usually receive an equal amount of the new forked coins on the new chain. This is known as a "fork dividend" or "airdrop." However, the value and legitimacy of these new coins can vary widely, and investors should exercise caution when dealing with forked coins.

Forks can also impact the security and stability of the network, as they can introduce new vulnerabilities and uncertainties. It is important for users to stay informed about upcoming forks and to follow best practices to protect their assets during these events.

1. Stay Informed: Keep up to date with news and announcements from the Bitcoin community to be aware of any upcoming forks or protocol changes.

2. Secure Your Assets: If you hold Bitcoin in a wallet or exchange, make sure to follow security best practices to protect your assets during a fork event.

3. Exercise Caution: Be wary of new coins that are created as a result of forks, as their value and security may be uncertain. Do thorough research before investing or transacting with forked coins.

4. Seek Guidance: If you are unsure about how to handle a fork or its implications, consider seeking advice from trusted sources or professionals in the cryptocurrency space.

Overall, Bitcoin forks are a natural part of the evolution of the network and can lead to innovation and improvements in the protocol. By understanding the different types of forks and their implications, users can navigate these events with greater confidence and security.