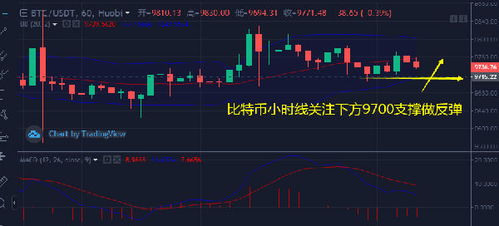

比特币止盈止损怎么设置

Title: Implementing a Bitcoin Stop Loss Strategy

Introduction

Implementing a stoploss strategy in Bitcoin trading can be a prudent approach to manage risk and protect your investment capital. In this guide, we'll delve into the concept of a stop loss, explain how it works in the context of Bitcoin trading, and provide insights into setting a stop loss of 100 points.

Understanding Stop Loss

A stop loss is an order placed with a broker to sell a security when it reaches a certain price. It's a risk management tool designed to limit an investor's loss on a position in a security. In the volatile world of cryptocurrency trading, stop losses are particularly valuable for mitigating risk.

Bitcoin Volatility and Risk Management

Bitcoin, known for its price volatility, can experience rapid price fluctuations within short periods. While this volatility presents opportunities for profit, it also exposes traders to significant risks. A wellexecuted stop loss strategy can help traders navigate this volatility more effectively.

Setting a Stop Loss for Bitcoin

When setting a stop loss for Bitcoin, it's crucial to consider both the overall market conditions and your individual risk tolerance. A stop loss of 100 points, in Bitcoin terms, refers to setting a threshold where you're willing to exit a trade if the price moves against you by 100 points (measured in dollars or your preferred fiat currency).

Steps to Implement a 100Point Bitcoin Stop Loss

1.

Choose a Reliable Exchange:

Select a reputable cryptocurrency exchange that supports stop loss orders.2.

Determine Entry Point:

Decide at what price point you want to enter the Bitcoin trade.3.

Calculate Stop Loss:

Calculate the price level that is 100 points below your entry point. For example, if you enter at $50,000, your stop loss would be set at $49,900.4.

Place Stop Loss Order:

Once your trade is executed, place a stop loss order at the predetermined price level.5.

Monitor and Adjust:

Regularly monitor the market conditions and adjust your stop loss if necessary. As the price of Bitcoin fluctuates, your stop loss level may need to be recalibrated to reflect changes in market dynamics.Benefits of a 100Point Bitcoin Stop Loss

1.

Risk Management:

By setting a predefined exit point, you can limit potential losses and protect your investment capital.2.

Emotion Management:

A stop loss helps remove emotional biases from trading decisions, allowing for more disciplined and rational decisionmaking.3.

Peace of Mind:

Knowing that you have a safety net in place can provide peace of mind, especially in highly volatile markets.

Conclusion

Implementing a stop loss strategy is essential for managing risk and safeguarding your investment in Bitcoin trading. A 100point stop loss can serve as an effective tool to protect against adverse price movements while allowing for potential upside gains. However, it's essential to tailor your stop loss strategy to your individual risk tolerance and market conditions. Regular monitoring and adjustments are key to ensuring the continued effectiveness of your stop loss strategy in the dynamic cryptocurrency market.

版权声明

本文仅代表作者观点,不代表百度立场。

本文系作者授权百度百家发表,未经许可,不得转载。

评论