Title: Exploring the Historical Trends of Bitcoin Prices

Bitcoin, the pioneer cryptocurrency, has captivated the world with its volatile price movements since its inception in 2009. Understanding its price history is crucial for investors, traders, and enthusiasts alike. Let's delve into the historical trends of Bitcoin prices and extract valuable insights.

Early Days: Genesis to 2013

Bitcoin emerged in 2009, initially with negligible value. The first recorded price of Bitcoin was in 2010 when a user traded 10,000 bitcoins for two pizzas, establishing a rough valuation. Throughout 2011 and 2012, its price remained below $10, with sporadic spikes.

2013: The Year of Breakthrough

In 2013, Bitcoin witnessed significant milestones. Its price surged from around $13 in January to over $1,100 in December, marking a remarkable uptrend. This exponential growth attracted widespread attention and investment, fueled by media coverage and growing acceptance in mainstream businesses.

20142015: Correction and Stability

Following the 2013 peak, Bitcoin experienced a substantial correction, with its price dropping to around $200$300 range in early 2014. Throughout 2014 and 2015, the market stabilized, albeit with fluctuations, as Bitcoin found support and began to build infrastructure for wider adoption.

20162017: Bull Run and AllTime Highs

The period from 2016 to 2017 saw Bitcoin's price embarking on another bullish trajectory. Factors such as increasing institutional interest, regulatory developments, and the emergence of blockchain technology contributed to its meteoric rise. In December 2017, Bitcoin reached its alltime high of nearly $20,000.

20182019: Bear Market and Consolidation

Following the peak in 2017, Bitcoin entered a prolonged bear market phase. Its price gradually declined throughout 2018, reaching around $3,000 by the end of the year. This period was characterized by regulatory uncertainties, security concerns, and market sentiment dampened by the bursting of the ICO bubble.

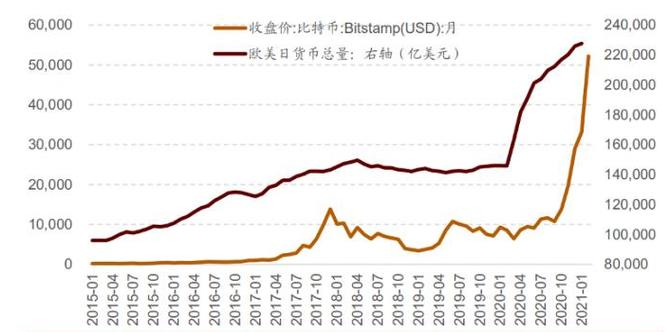

20202021: Resurgence and Institutional Adoption

Bitcoin's price dynamics shifted again in 2020, as it rebounded from the lows of the previous year. Institutional investors, such as MicroStrategy and Tesla, began allocating significant portions of their portfolios to Bitcoin, viewing it as a hedge against inflation and a store of value. This newfound institutional interest propelled Bitcoin to surpass its previous alltime high in late 2020, reaching over $60,000 in April 2021.

2022Present: Maturing Market and Price Volatility

In recent years, Bitcoin's price has exhibited a blend of volatility and maturity. While still subject to sudden price swings driven by market sentiment and external factors, Bitcoin has garnered more mainstream acceptance. Regulatory clarity, integration into traditional financial systems, and growing retail and institutional adoption have contributed to its resilience.

Conclusion: Navigating the Future

Understanding Bitcoin's price history provides valuable insights into its market dynamics and potential future trends. While past performance is not indicative of future results, historical data can guide investors in making informed decisions. As Bitcoin continues to evolve and integrate into the global financial landscape, staying informed about its price movements and underlying fundamentals is essential for navigating the everchanging crypto market landscape.

In summary, Bitcoin's price history is a testament to its transformative journey from obscurity to global recognition. Whether viewed as a speculative asset, a digital gold, or a disruptor of traditional finance, Bitcoin's price trajectory reflects the interplay of technological innovation, market forces, and human psychology shaping the future of finance.

[End of Document]

版权声明

本文仅代表作者观点,不代表百度立场。

本文系作者授权百度百家发表,未经许可,不得转载。

评论