比特币持有者

Understanding Common Abbreviations in the Bitcoin Community

Bitcoin, the pioneering cryptocurrency, has spawned a vast ecosystem with its own language and jargon. For those new to the scene, deciphering these abbreviations can feel like decoding a foreign language. One such abbreviation that frequently pops up in discussions among Bitcoin holders is "HODL." Let's delve into its meaning and significance within the Bitcoin community.

HODL: Holding On for Dear Life

HODL

stands for "Hold On for Dear Life." It originated from a misspelled word in a 2013 Bitcoin Talk forum post titled "I AM HODLING." The author, in a moment of frustration during a market downturn, meant to write "holding" but instead typed "hodling." This typo gained popularity and became a rallying cry for Bitcoin enthusiasts advocating for holding onto their investments regardless of shortterm market fluctuations.The Philosophy of HODL

The philosophy behind HODLing is rooted in the belief that Bitcoin's longterm potential outweighs its shortterm volatility. Instead of attempting to time the market or engage in frequent trading, HODLers maintain their positions through market ups and downs, trusting in the fundamental value proposition of Bitcoin as a decentralized digital currency and store of value.

HODLing vs. Trading

HODLing differs significantly from active trading strategies, where investors buy and sell assets frequently in an attempt to profit from price fluctuations. While trading can potentially yield shortterm gains, it requires considerable time, effort, and expertise. Additionally, the majority of traders fail to consistently beat the market over the long term due to the unpredictable nature of price movements.

In contrast, HODLing is a passive investment strategy that requires less active management. It is particularly appealing to those who believe in Bitcoin's disruptive potential and prefer to take a longterm view of their investments. By HODLing, investors seek to benefit from Bitcoin's overall upward trajectory while avoiding the stress and uncertainty associated with shortterm trading.

Risks and Considerations

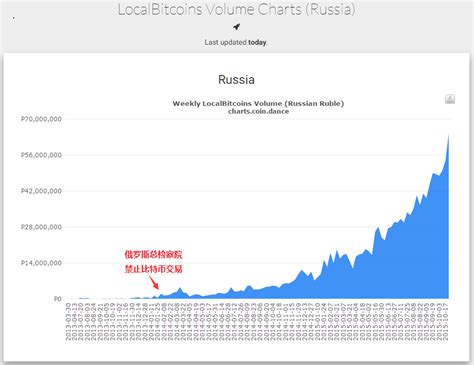

While HODLing offers several advantages, it's not without risks. Bitcoin's price can be highly volatile, and significant downturns can test the resolve of even the most committed HODLers. Additionally, external factors such as regulatory changes, technological developments, and market sentiment can impact the value of Bitcoin.

Furthermore, HODLing requires discipline and conviction. It's essential to conduct thorough research and understand the factors driving Bitcoin's adoption and value proposition. Investors should also consider their risk tolerance and financial goals before adopting a HODLing strategy.

Conclusion

In the world of Bitcoin, "HODL" symbolizes more than just a misspelled word—it represents a mindset of resilience and longterm vision. By embracing the philosophy of HODLing, investors align themselves with the core principles of decentralization, financial sovereignty, and trustless peertopeer transactions that underpin Bitcoin's revolutionary technology.

While HODLing may not be suitable for everyone, it offers a compelling alternative to active trading for those who believe in Bitcoin's potential to reshape the future of finance. Whether you're a seasoned Bitcoin veteran or a newcomer to the space, understanding the significance of HODLing can provide valuable insights into the ethos of the Bitcoin community and its steadfast commitment to building a more equitable and inclusive financial system.

版权声明

本文仅代表作者观点,不代表百度立场。

本文系作者授权百度百家发表,未经许可,不得转载。

评论