Title: Analyzing the Latest Indicators of Bitcoin's Sharp Decline

Bitcoin's recent sharp decline has been a topic of concern for many investors and analysts. Several key indicators can shed light on this phenomenon. Let's delve into these indicators to understand the factors contributing to Bitcoin's current downturn.

1. Market Sentiment:

Market sentiment plays a crucial role in Bitcoin's price movements. Negative sentiment stemming from regulatory concerns, security breaches, or macroeconomic factors can lead to selloffs. Monitoring sentiment through social media, news sentiment analysis, and surveys can provide insights into investor sentiment towards Bitcoin.

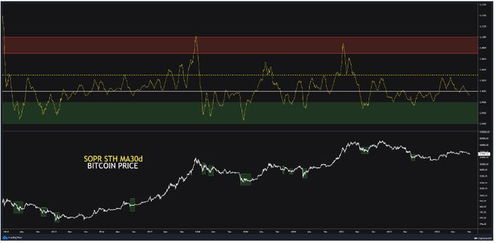

2. Technical Analysis:

Technical analysis involves studying price charts and trading volumes to identify patterns and trends. Key technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can signal overbought or oversold conditions. A sudden drop below key support levels or a bearish chart pattern may indicate a potential downtrend.

3. Regulatory Developments:

Regulatory announcements and actions by governments can significantly impact Bitcoin's price. Negative regulatory news, such as bans or restrictions on cryptocurrency trading, can trigger panic selling among investors. Monitoring regulatory developments globally and their potential implications on Bitcoin can help anticipate price movements.

4. Institutional Activity:

Institutional investors' involvement in the cryptocurrency market has grown significantly in recent years. Large selloffs or purchases by institutions can influence market sentiment and liquidity. Monitoring institutional activity through exchange data or institutional trading platforms can provide insights into their current stance on Bitcoin.

5. MacroEconomic Factors:

Bitcoin's price is also influenced by broader economic factors such as inflation, interest rates, and geopolitical tensions. Economic indicators like GDP growth, inflation rates, and unemployment figures can affect investor risk appetite and preference for alternative assets like Bitcoin. Keeping track of macroeconomic trends can help assess Bitcoin's future price trajectory.

6. Network Fundamentals:

Bitcoin's network fundamentals, including hash rate, transaction fees, and active addresses, provide insights into its underlying strength and adoption. A decline in network activity or miner capitulation may signal weakening confidence among participants. Analyzing these metrics can help gauge the longterm viability of Bitcoin as an asset class.

Conclusion:

Bitcoin's recent sharp decline can be attributed to a combination of factors, including negative market sentiment, regulatory uncertainties, and macroeconomic conditions. By closely monitoring key indicators such as market sentiment, technical analysis, regulatory developments, institutional activity, macroeconomic factors, and network fundamentals, investors can gain a better understanding of Bitcoin's price movements and make informed decisions.

Disclaimer:

This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile, and investors should conduct thorough research and consult with financial professionals before making investment decisions.```html

Analyzing the Latest Indicators of Bitcoin's Sharp Decline

Bitcoin's recent sharp decline has been a topic of concern for many investors and analysts. Several key indicators can shed light on this phenomenon. Let's delve into these indicators to understand the factors contributing to Bitcoin's current downturn.

Market sentiment plays a crucial role in Bitcoin's price movements. Negative sentiment stemming from regulatory concerns, security breaches, or macroeconomic factors can lead to selloffs. Monitoring sentiment through social media, news sentiment analysis, and surveys can provide insights into investor sentiment towards Bitcoin.

Technical analysis involves studying price charts and trading volumes to identify patterns and trends. Key technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands can signal overbought or oversold conditions. A sudden drop below key support levels or a bearish chart pattern may indicate a potential downtrend.

Regulatory announcements and actions by governments can significantly impact Bitcoin's price. Negative regulatory news, such as bans or restrictions on cryptocurrency trading, can trigger panic selling among investors. Monitoring regulatory developments globally and their potential implications on Bitcoin can help anticipate price movements.

Institutional investors' involvement in the cryptocurrency market has grown significantly in recent years. Large selloffs or purchases by institutions can influence market sentiment and liquidity. Monitoring institutional activity through exchange data or institutional trading platforms can provide insights into their current stance on Bitcoin.

Bitcoin's price is also influenced by broader economic factors such as inflation, interest rates, and geopolitical tensions. Economic indicators like GDP growth, inflation rates, and unemployment figures can affect investor risk appetite and preference for alternative assets like Bitcoin. Keeping track of macroeconomic trends can help assess Bitcoin's future price trajectory.

Bitcoin's network fundamentals, including hash rate, transaction fees, and active addresses, provide insights into its underlying strength and adoption. A decline in network activity or miner capitulation may signal weakening confidence among participants. Analyzing these metrics can help gauge the longterm viability of Bitcoin as an asset class.

Bitcoin's recent sharp decline can be attributed to a combination of factors, including negative market sentiment, regulatory uncertainties, and macroeconomic conditions. By closely monitoring key indicators such as market sentiment, technical analysis, regulatory developments, institutional activity, macroeconomic factors, and network fundamentals, investors can gain a better understanding of Bitcoin's price movements and make informed decisions.

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Cryptocurrency markets are highly volatile, and investors should conduct thorough research and consult with financial professionals before making investment decisions.